With Enrico Cacciatore, Head of Market Structure & Trading Analytics, Voya Investment Management, and Tim Sargent, CEO, CalcGuard Technologies

What have been some challenges as the Routing Transparency Initiative (RTI) has moved forward?

ENRICO CACCIATORE: The biggest challenge for RTI is the inherent lack of standardized data and lack of data collaboration tools.

How does the buy side get routing information? It usually comes from the brokers through end-of-day or end-of-quarter extract files made available to third parties or directly to the investment manager. Through the RTI efforts to date, it has become clear that the buy side wants to develop better intelligence through a multi-dimensional view of their order as it is handled. This is not possible from a single broker extract. Even for less sophisticated investment managers who can live with a single dimension, the lack of consistency in how the data is represented across brokers has led to poor usability, and this is no longer acceptable. As our current market structure has caused the amount of data to grow, the use of extract summaries creates further ambiguity. Lastly, these larger data sets have become unwieldy to manage causing increased risk of information leakage as files are being pushed around FTP servers. Increasingly, brokers are concerned with the liabilities this creates.

RTI is about creating a new source of intelligence to inform the investment and trading decision process. Realizing this objective requires the industry to come together and rethink how trade data is produced and shared. People have tried to pigeonhole RTI into TCA, but it’s not TCA. It is a plumbing issue – it’s about how transactional data is created, managed and consumed.

What have been some ideas to address the challenges?

ENRICO: Tim Sargent of CalcGuard Technologies brought ideas to the table. I have also been working on RTI with Jim Northey of FIX Trading Community. Jim was implementing a methodology called simple binary encryption, as a way to transport a machine-readable intention code within FIX. You could append to that information in one FIX message, so it allows for complexity without creating overhead in the messaging. The FIX messages can then be aggregated across the order handling lifecycle to create a complete picture.

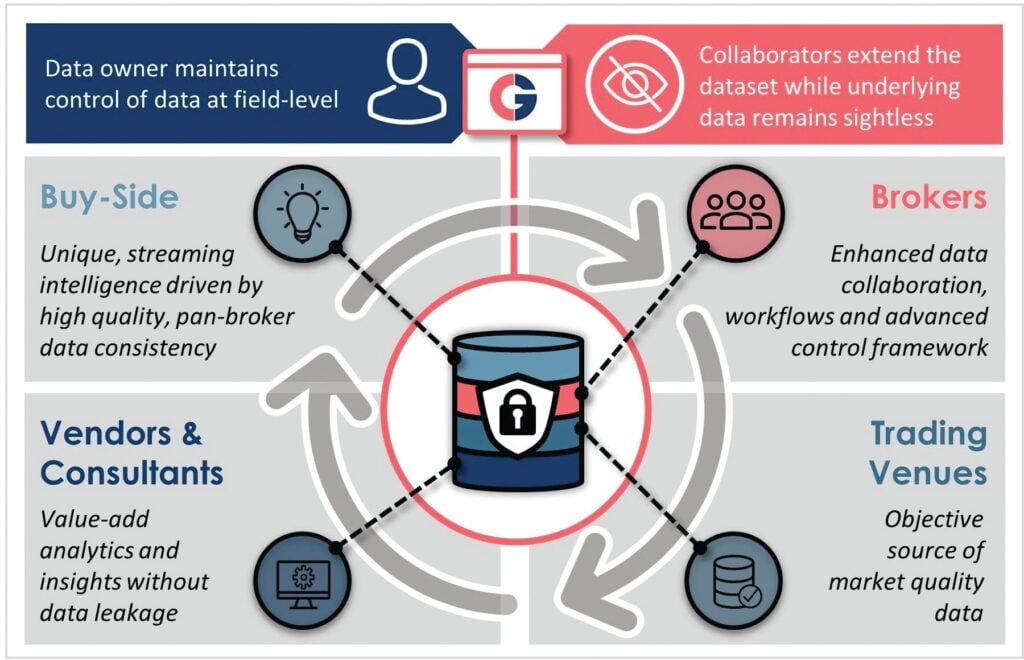

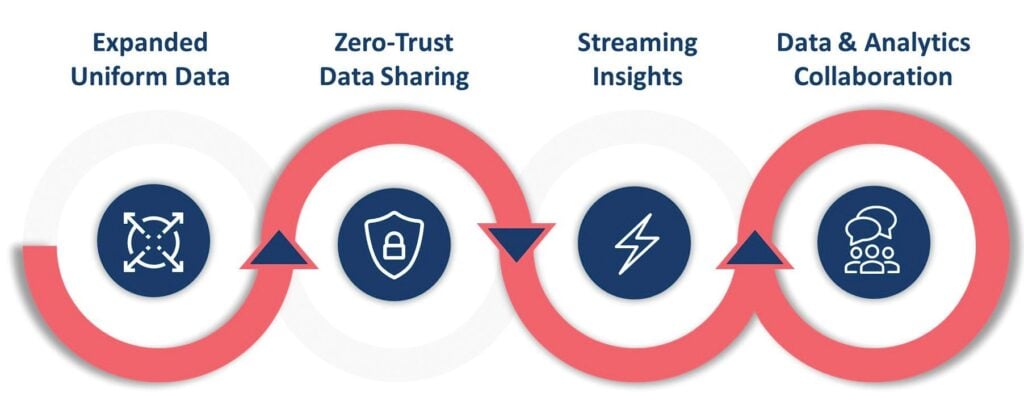

But achieving the data consistency required is still the problem. The CalcGuard initiative is a consortium-driven platform designed to support standardized data collaboration in a highly secure way. The latest developments in data encryption and cloud-native technology make it possible to enhance, normalize and share the trade data while providing increased control for the broker. The data model and governance controls can be shared across a common infrastructure while the data remains local and encrypted. The data can then be shared over any network in real-time while the control over who can access the data, down to the field level, is centralized through a common command and control framework. This is the future of how data is managed; there is no longer such thing as a secure network. The data itself must be secured in a way that enables the industry to leverage the improved operational efficiencies of cloud-native technology to better manage the data which supports critical intelligence. CalcGuard is applying these developments to real-time data which can be useful beyond routing information. Cantor can provide me with access to their routing information enhanced with intention codes provided by third-party algos. Or, XTX Markets could stream me their quotes across the public cloud and control permission to the data so that only I can look at it as a paying subscriber. The entitlements and permissions can be managed by each of the consortium participants to anyone, even outside of the consortium or CalcGuard platform.

Tim how did you get involved with RTI?

TIM SARGENT: When I started Quantitative Services Group, we were servicing the quantitative trading community with signal-based analytics -- we needed to be able to back-test with a complete implementation picture, because a lot of these things don’t survive execution. So we got into what was the TCA space – it illuminated many of the unique challenges that investment managers and their brokers face. After I sold QSG to Markit in 2011, I reflected on these challenges and the fact that we hadn’t meaningfully advanced trading analytics in about 30 years.

So I spoke to buy-side people I knew well. I said, “It’s never going to get solved by a vendor. It’s never going to get solved by a broker. And it’s never going to get solved on the buy side. The lift requires cooperation.” This was about four years ago now. I said, “I think I’ve got one more in me. What we need to do is get the political will to come together as a consortium and deal with this data issue.”

That’s what inspired me to get involved.

How have you procured industry buy-in?

TIM: We have all been around the industry long enough to know that success requires that the interests of the industry are served first. Our partners do not want another super vendor. We’ve taken a consortia-driven approach which ensures that he industry will guide and own this initiative. There are plenty of product innovation ideas, but all are dependent on the existing upstream business processes. In today’s data-driven markets, the business processes are also in need of change and have outlived their usefulness. The opportunity to bring the sell side together to share in the costs of innovation, while responding simultaneously to the needs of their clients, presents a powerful opportunity for meaningful innovation. The investment management community has learned that enhancing data through standardization is more effectively and efficiently accomplished through consortia models than regulatory policy. So we started with the group who had already been working together on the RTI initiative, since it became clear that the requirements for success of that initiative have broader potential for the entire industry.

The RTI initiative is now part of the agenda for the Investment Management Advisory Council (IMAC) we have organized to lead the design and prioritization process going forward. The IMAC, along with the platform and governance model we have designed, provides the framework needed to support the innovation process. The shared cost and the alignment enabled by the consortium model has unlocked the investment decisions. We are now looking to close the initial round of funding with a handful of leading organizations who have helped us get to where we are now. From this point forward, we just need to do what we said we would do, and success will follow.

How will this effort be structured?

TIM: The consortia is comprised of 20 buy-side and 20 sell-side organizations organized into advisory functions, including the IMAC, which drive the priorities and design of the platform. The Street will drive the data standardization, sharing the costs of the effort with all consortium participants for everyone’s collective benefit. The costs are recovered by lowering the operational overhead for everyone on the platform, including vendors. The platform does all the heavy lifting and reduces the burden on everyone managing trade data while simultaneously standardizing and enhancing the data to increase its value. We are starting with a focus on global equities in the first stage, then we’ll move to other asset classes as prioritized by the consortia.

What direction has RTI taken since being introduced to the industry in 2019?

TIM: RTI has evolved considerably. We’ve established the level of interest and support to the point where the initiative has reached the execution phase. It has become clear to everyone involved that the requirements to support RTI have broader potential to drive innovation across the trading and investment decision process. This led to the decision to fold the effort into CalcGuard and to ensure that RTI leadership is well represented.

What’s next?

TIM: The first IMAC meeting was held in early April. We’re now finalizing the investment partners for participation in the rolling funding model. We expect to secure the initial commitments in Q2 and kick off the build in Q3.

Update on Routing Transparency Initiative first appeared on GlobalTrading.