13 systematic internalisers received market identifier codes last month.

The Swiss market now has 99 trading participants.

MiFID II requires fund managers to track consumption and quality of research.

Market-on-Close futures facilitate shift from OTC trading.

MiFID II introduces post-trade transparency reports for OTC trades.

MiFID II requires more accurate timestamping of trades.

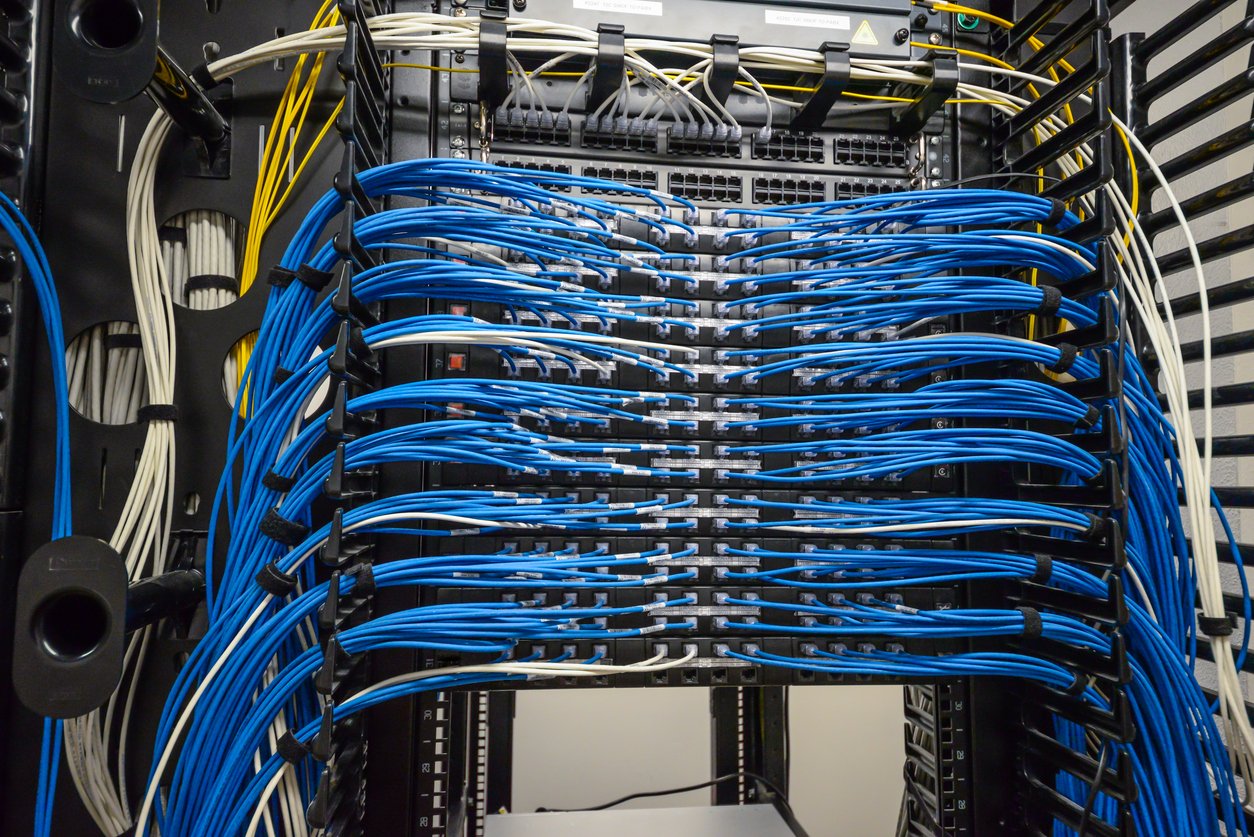

Trading in multiple asset classes requires secure, reliable and efficient connectivity.

The exchange wants to increase the audience for proprietary data.

The trading business isn't what it used to be.