The Margin Segregation Service streamlines processes for meeting uncleared margin rules.

The fintech provides a shared workflow to help resolve errors in the fragmented trade settlement process.

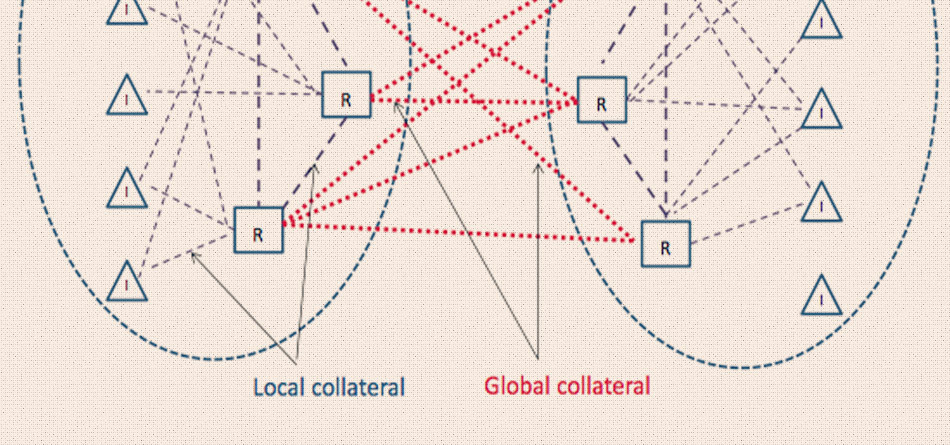

DLT networks or tokenisation platforms have the potential to transform post-trade.

Buy side are concerned they will bear increased costs of widening spreads and decreased liquidity.

Regulations SFTR and CSDR highlight risks of not having an efficient trade confirmation solution.

The model uses one single settlement location for exchange-traded and OTC, cleared and non-cleared activities.

As ASX moves to replace CHESS, market participants look to what else the technology can deliver.

Proof of concept lays the foundation for a leap in efficiency in post-trade services.

Both parties need to report trades to a recognised trade repository.