Swap rate settings for other alternative, overnight rates will be published as markets develop.

Three UK central counterparties can provide their services in the EU after the end of the transition period.

It is important for liquidity to develop in the new risk free benchmark rates.

Futures market will help to create a forward curve so water users can hedge price risk.

Majority of asset managers are unprepared despite deadline extension.

The firm's technology helps financial institutions free up capital.

Lenders should be able to offer non-LIBOR alternatives to customers by the end of this month.

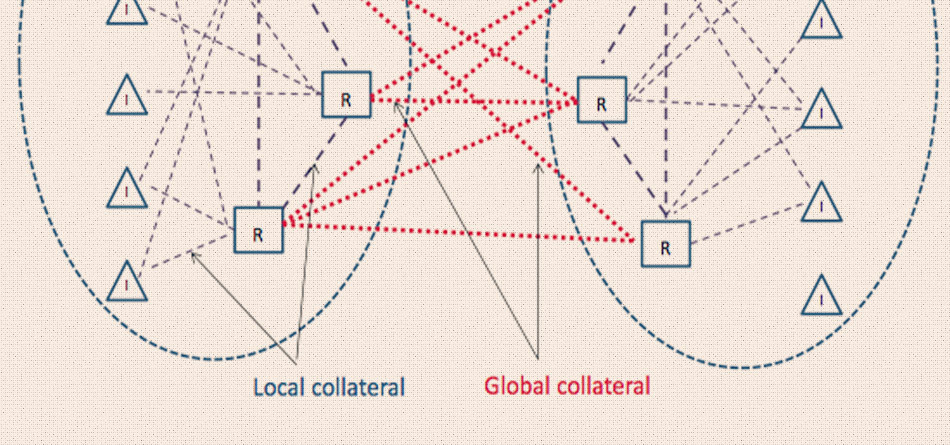

The failure of one CCP has the potential to cause serious systemic risk across the EU.

This will aid the transition from LIBOR by providing a rate based on overnight indexed swaps.