Majority of firms are also not monitoring best execution despite this being mandated.

MiFID II has not delivered on its objective to reduce the cost of market data.

The phase-in by EMMI occurred gradually to minimise operational and technological risks for panel banks.

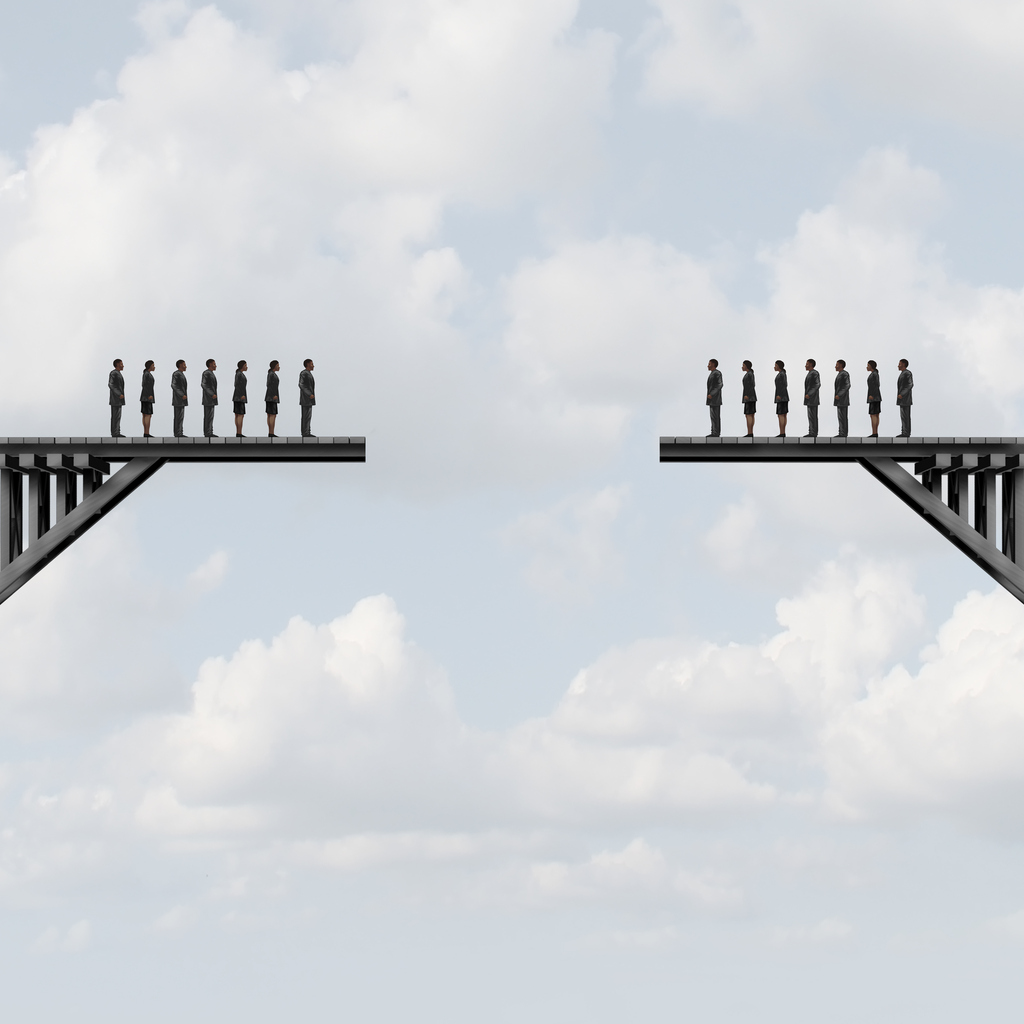

Buy side are concerned they will bear increased costs of widening spreads and decreased liquidity.

Market participants need to prepare for life without Libor.

Regulations SFTR and CSDR highlight risks of not having an efficient trade confirmation solution.

Loan markets have yet to move from Libor to the risk free rates.

Deutsche Bank's European Commercial Real Estate group transitions loan from Libor.

SFTR will introduce new reporting obligations from April 2020.