The firm will reinforce its position as the largest DMM on the NYSE by number of securities and market cap.

The bank failed to exercise proper oversight of the 2016 decommissioning of two data centers.

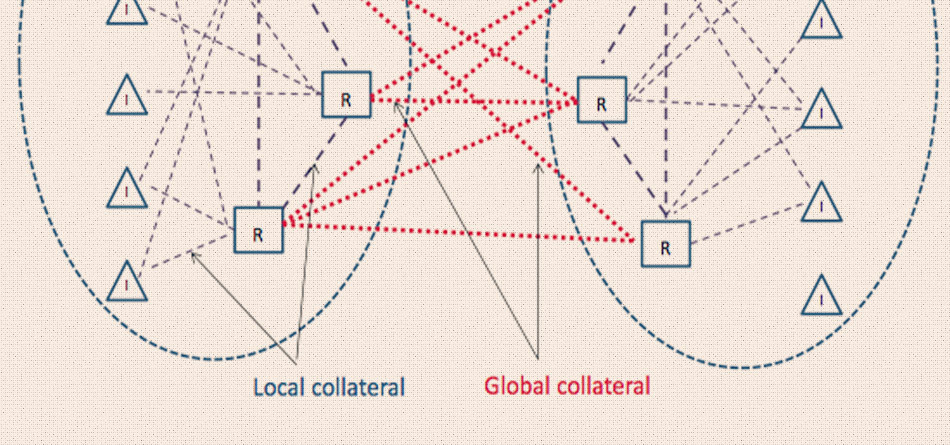

The bank will be able to implement automated rules to optimize the movements of cash and securities.

Investigation of central bank digital currencies is continuing without committing to issuance.

Active ESG equity funds accounted for all new money flowing into active funds since late 2018.

The bank is required to enhance its firm-wide risk management and internal controls.

ECB received 44 replies to the consultation on publication of backward-looking compounded rates.

This is an important first step in the evolution of the agoraSmartbond.

This follows the recent launch of clearing of the iTraxx ESG index.