NEX unit will electronically manage confirmations and payments for equity swaps.

US regulators have given a six-month reprieve from new margin rules.

Regulations have cut the number of derivatives clearing firms.

Firms will not be able to trade if documentation is not completed.

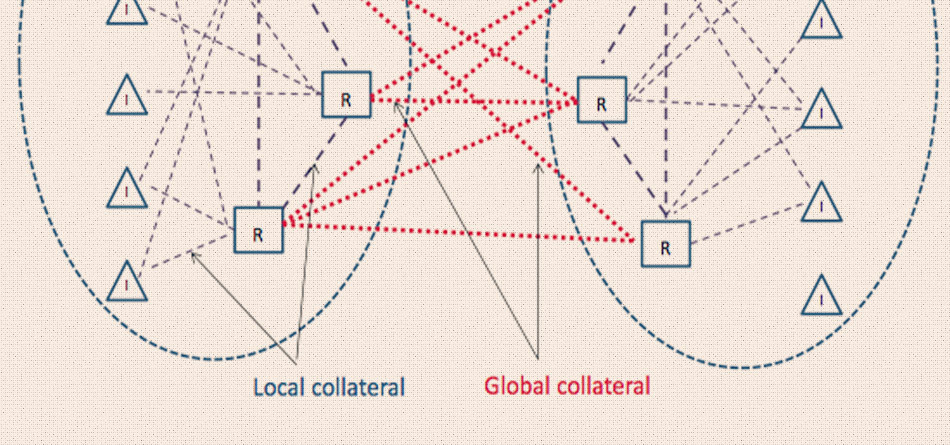

Market fragmentation is a key challenge, writes Brian Dunton of Eagle Investment Systems.

Uncleared margin rules are driving derivatives into central clearing.

MiFID II requires OTC derivatives to have a product reference number.

New margin requirements for bilateral instruments will make exchange-traded derivatives more attractive.

Outgoing Chair cites swaps regulatory framework and systemic risk mitigation as accomplishments.