Majority of asset managers are unprepared despite deadline extension.

SwapClear offers clearing for interest rate derivatives across 27 global currencies.

Managing Climate Risk in the U.S. Financial System is the first from a U.S. government entity.

New ICB classification leads to one new and three redefined supersectors.

LCH will then cover nearly all of the FX market that is available to clear.

The firm will no longer be limited to clearing digital currency products.

The contracts have a notional value a tenth the size of the standard OMXS30 futures.

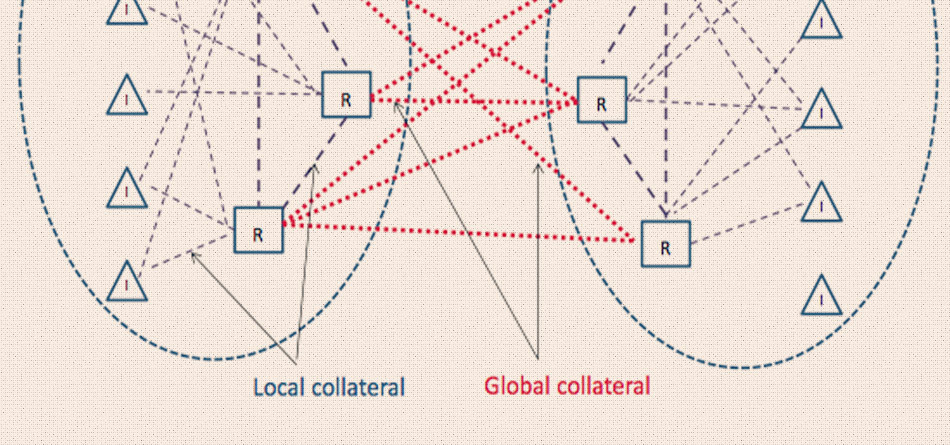

Cash accounts for 70% of all collateral exchanged for non-cleared derivatives, $1.3 trillion in 2019 alone.

New policy paper outlines how derivatives markets can help build a more sustainable future.