The multiparty derivatives platform removes the need to deal with central issuers of derivatives/CFDs.

The venue provides pan-European trading for securitised derivatives.

This will increase transparency in the OTC derivatives market.

Asset managers are using RFQ-hub to electronically negotiate derivatives transactions.

Katana screens over 200 million bond pairs and uses machine learning to uncover spread difference anomalies.

ICE Singapore listed futures based on its recently launched Asia Tech 30 Index.

Unique Product Identifier facilitates aggregation of OTC derivatives transactions globally.

ISDA urges the EU to grant permanent equivalence to UK CCPs.

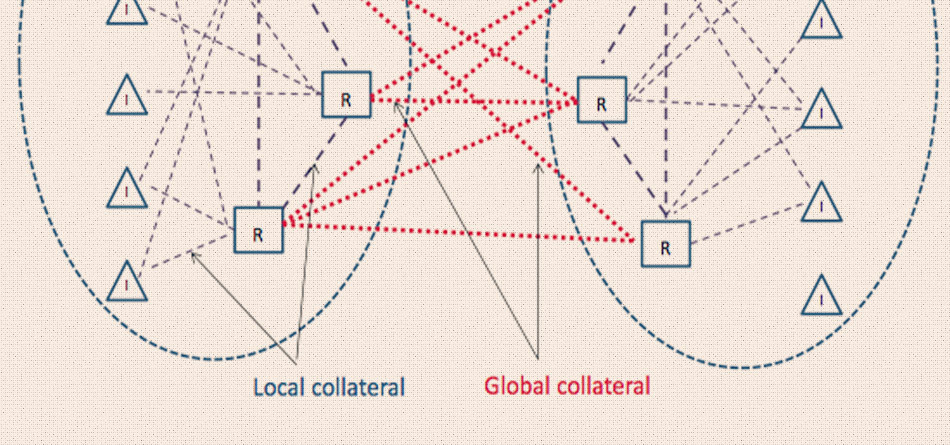

In 2019 Baton and J.P. Morgan developed near real-time collateral transfers to multiple CCPs.