QB’s Algo Suite for futures market trade execution is also being co-located to HKEX.

Smaller entities come into scope in phase five of the uncleared margin regulations on September 1.

Mysteel will operate the venue which uses a private matching solution developed by TT.

Once futures are in place, other derivatives such as options should follow.

New interest rate futures aim to support transition away from LIBOR.

The exchange aims to build an offshore Mainland China equities derivatives suite in Hong Kong.

This offering will be the first regulated market in Bitcoin-related derivatives in Europe.

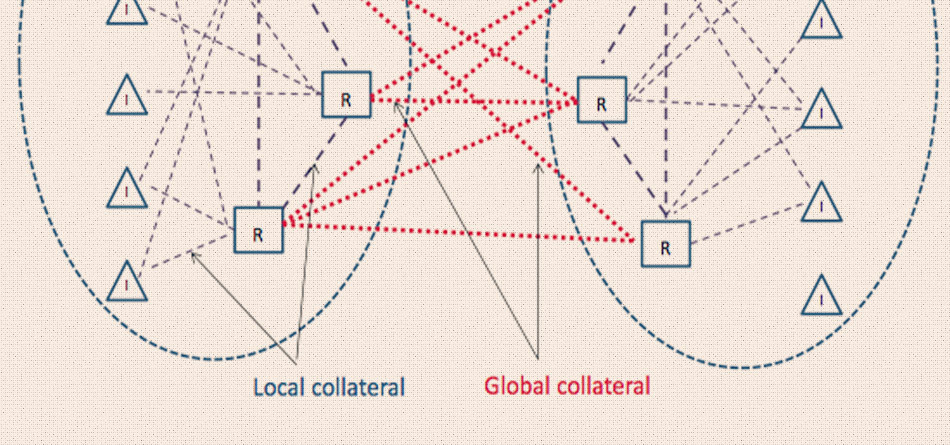

A significant proportion of total collateral held with CCPs globally can be automatically optimized.

Phase five of the uncleared margin rules come into effect in September.