MiFID II introduces changes to transaction reporting from 3 January 2018.

Lack of robust data is greatest barrier to ESG adoption.

Counterparties will not be able to trade without legal entity identifiers.

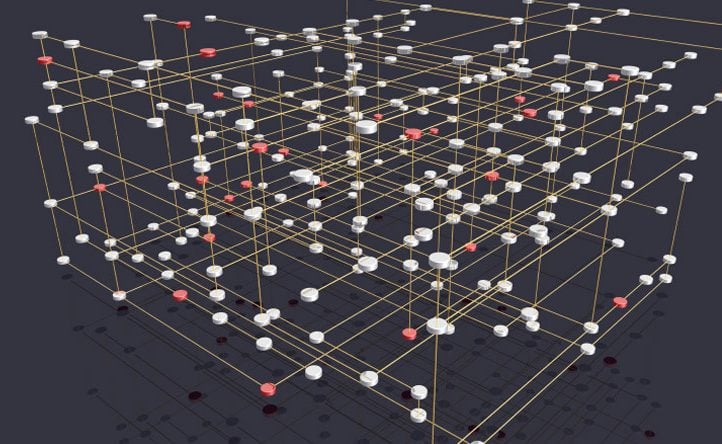

Algomi ALFA aims to be a ‘game changer’ for price discovery.

MiFID II requires large or illiquid bond trades to be reported within 48 hours.

Liquidity was a major topic at the MarketAxess and Trax European Capital Markets Forum in London.

Banks are looking to increase their digital workforce of software robots.

European bond-trading platform is ready to cross the Atlantic.

EMS provides launches new hosted tick data system.