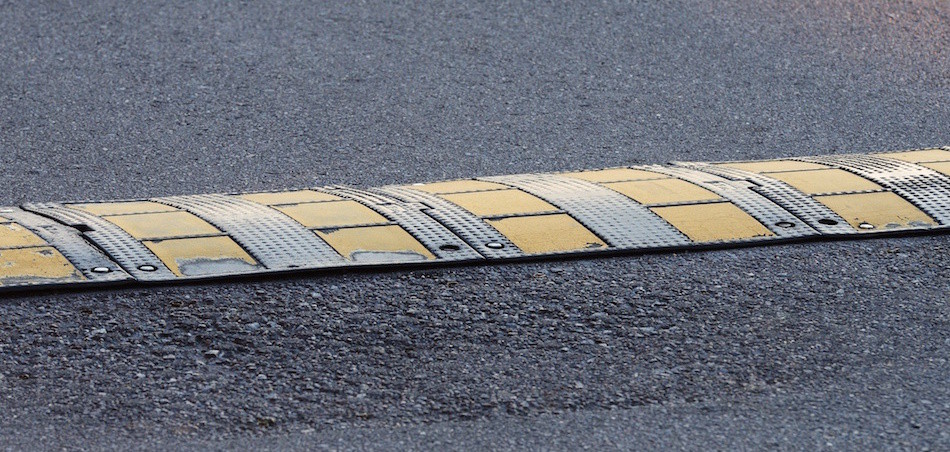

The issue of speed bumps in markets has risen to prominence in the wake of the publication of Michael Lewis’ book Flash Boys and the ensuing brouhaha over high-frequency trading.

In Canada, TMX Group plans to introduce by the end of 2015 a new Long Life order type on its TSX and TSXV exchanges. These orders will be required to commit to a minimum resting time of one second in the book, and in return, Long Life orders will receive priority over non-Long Life orders at the same price.

Jos Schmitt, Aequitas

Jos Schmitt, Aequitas

It’s part of larger effort by TMX to create a domestic trading model for participants who do not use speed-based trading strategies, and is intended to address the issue of Canadian dealers looking to execute natural trading flow with wholesalers in the U.S., where, unlike in Canada, customer segmentation and payment for order flow are permitted.

TMX also announced changes to its Alpha trading platform, where a short order-processing delay (speed bump), together with the minimum size threshold for liquidity-providing orders and rebates for active flow, will deliver superior execution quality for natural investors and reduce trading costs for retail and institutional dealers, according to a TMX release.

Jos Schmitt, CEO of Aequitas NEO Exchange, which has received approval from the Ontario Securities Commission to launch an exchange in March 2015, decried the TMX offering as “smoke and mirrors” which will promote, rather than hinder, predatory HFT strategies.

“They are proposing to slow everyone down with the exception of those who use one order type - the Post Only order - which is used by high frequency traders to stay at the top of the book,” Schmitt told Markets Media. “So not only do they provide high frequency traders tools to enable their speed, such as co-location and a microwave network, but now they want to make changes to one of their markets to protect them. It’s like the shark tank keeper giving the keys to the sharks.”

Schmitt will be speaking at Markets Media’s Global Markets Summit New York on Nov. 20.

According to Schmitt, the Post Only order is designed to be cancelled prior to trading with an order that is already in the book. “You can imagine that it’s not a long term investor that is using an order that gets cancelled if it would trade,” he said. “It’s people who sit at the top of the book and we know who is doing that. “It all sounds great but then when you look at the detail, it turns out that it’s pretty much the opposite of what they claim to achieve.”

The Aequitas application that was approved by the OSC is based on the original business plan published in 2013, together with a number of amendments that resulted from the comment process initiated by the OSC, as well as the company’s own dialogue with regulators.

The mechanism to disrupt predatory high-frequency trading strategies when taking liquidity in the NEO book will, rather than restricting access, make these strategies uneconomic through a combination of trading fees and speed bumps.

“We discussed a number of key features with the regulators, and then it was agreed to put that forward for public comment, and in light of the principles of what we hope to achieve, we’re absolutely executing upon those,” Schmitt said.

Featured image via Dollar Photo Club