Nearly half of North American financial institutions are planning to conduct layoffs and rationalize compensation next year according to Deloitte.

A survey found that one third, 35%, of senior executives and 46% of North American financial institutions are planning layoffs and cuts in compensation as one way to cut costs over the next 6 to 12 months.

The Deloitte US Center for Financial Services conducted a global survey among 200 senior banking and capital markets executives in finance, operations, talent, and technology.

https://twitter.com/DeloitteUK_FS/status/1335967424819105796

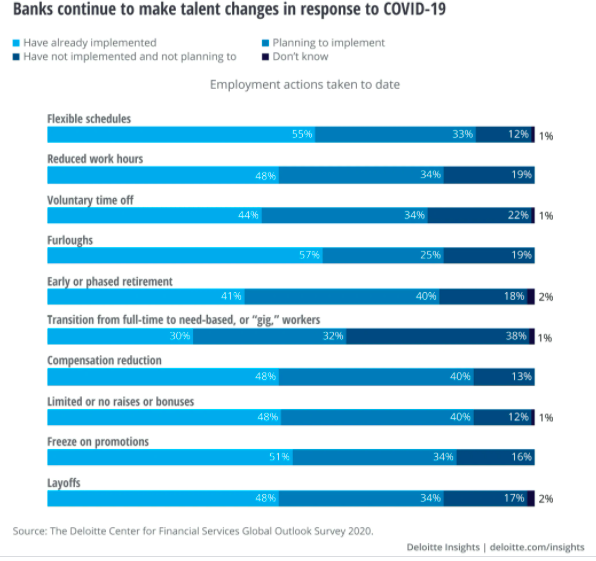

Many banks took, or are planning to take, workforce-related actions such as offering flexible schedules.

“But they have also had to deal with the economic realities brought on by the pandemic, forcing some to reduce their workforce and reconfigure the compensation structure,” said the survey.

Source: Deloitte

Source: Deloitte

The pandemic is likely to transform talent and organisational models in the banking industry said Deloitte.

“COVID-19 has revealed that many banks still have outdated organizational structures and hierarchies,” added the report. “New team structures should be tied directly to how work gets done.”

Technology

The pandemic has accelerated digitization and the majority, 56%, of respondents will increase spending on cloud over the next year and 42%anticipate more investment in artificial intelligence technologies.

“Until now, cloud migration efforts were predominantly focused on cost reduction, modernizing the technology stack, and more recently, virtualizing the workforce,” added the report.

The pandemic highlighted the relative strength of banks’ digital infrastructure.

“While institutions that made strategic investments in technology came out stronger, laggards may still be able to leapfrog competitors if they take swift action to accelerate tech modernization,” said Deloitte.

Technology is expected to be become more critical as the macroeconomic environment and low interest rates fundamentally change the banking industry. Revenues in traditional segments are likely to have only moderate growth and scale will become critical. However, one area of growth is environmental, social, and governance financing.

ESG

Three-quarters of respondents to the survey said their institutions will increase investment in climate-related initiatives.

Deloitte gave the example of Goldman Sachs saying it will deploy $750bn (€620bn) across investing, financing, and advisory activities by 2030 and UBS increasing its core sustainable investments by more than 56% to $488bn.

Deutsche Bank this week set annual growth targets for ESG businesses and will link them to management compensation from next year.

https://twitter.com/DeutscheBank/status/1335949183170326530

The bank said the volume of sustainable financing and client investments is set to reach more than €20bn euros in the current year and to rise to more than €200bn euros by 2025. Compensation will be tied to the annual target volume for sustainable finance, ESG investments, a sustainability ratings index and a reduction in power consumption in its buildings by 10% versus 2019.

“Banks should also bolster their transition risk services and solutions to clients as they decarbonize,” added Deloitte. “The field is ripe for capital market innovations to create and trade carbon credits, and, more broadly, share climate risk across market participants”