Rick McVey, chairman and chief executive of MarketAxess, said the fixed income electronic trading platform and market data and post-trade service provider, is aiming for half of its revenues to come from outside the US over the next five to seven years.

McVey said at the MarketAxess investor day on 14 September that international has grown from 15% of total revenue in 2016 to 28% currently as clients from 64 countries trade bonds in more than 35 currencies.

Rick McVey, MarketAxess

Rick McVey, MarketAxess

“We believe that if we have the same success internationally as in our US business, revenues will be roughly 50/50 over time," he added.

Geographic diversification is one of MarketAxess’ four pillars of growth alongside increasing market share in core credit products; expanding into new products; and growing trading protocols and the Open Trading network, the firm’s all-to-all trading model.

McVey continued there are many untapped global opportunities, including emerging markets, where electronic trading is approximately only 10% and in single digits in some countries, and he is excited about China and Asia.

“Local emerging markets are an enormous opportunity as they are in the very early days of electronification,”he added. "We offer Chinese government bonds in hard currencies today and we expect to be able to offer local markets in the second half of this year in the third largest government bond market in the world.”

Christophe Roupie, head of EMEA and APAC at MarketAxess, said at the investor day that Open Trading has gained significant traction in Europe, growing from single digits in 2016 to close to 25% last year.

Christophe Roupie, MarketAxess

Christophe Roupie, MarketAxess

In addition the combined dealer network almost doubled in the two regions and 300 more clients are trading three or more products over the same time period. In Asia Pacific, the client base has grown beyond Singapore and Hong Kong to Taiwan, Japan, South Korea and Australia. APAC volume growth is up nearly 40% year-over-year from a record 2020.

“Emerging markets are becoming a showcase for new protocol adoption and technology enhancements,” Roupie added.

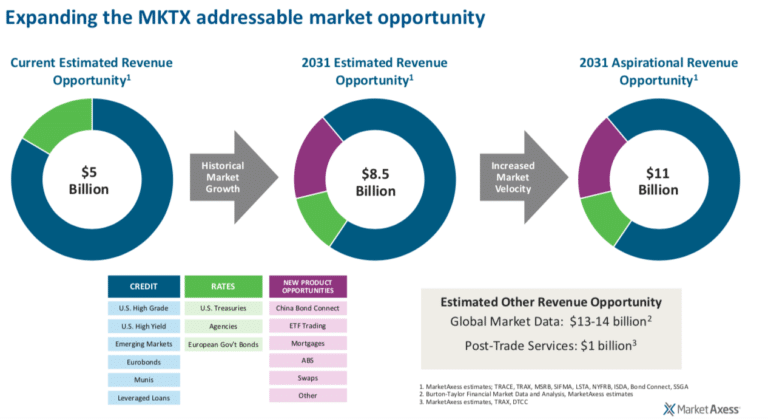

Based on historical growth rates, MarketAxess’ total revenue is projected to grow from the current $5bn per annum opportunity to $8.5bn. However if trading velocity increases, the opportunity could grow to $11bn.

Source: MarketAxess.

Source: MarketAxess.

“Our belief is that fixed income will follow the path of other asset classes towards 75% electronification over time,” McVey said.

Open Trading

McVey described MarketAxess as the only platform embraces all-to -all trading in everything it does.

“Our Open Trading offering is unique and delivers valuable liquidity to fixed income markets to reduce transaction costs and diversify the sources of market liquidity,” McVey added.

Kevin McPherson, global head of sales, said at the investor day that MarketAxess is actively working to extending Open Trading across all products including US Treasuries, leveraged loans and municipal bonds, which will drive market share growth.

Municipal bonds

One of the areas that McVey is most excited is municipal bonds as it is fragmented and still very manual, especially in the institutional market.

“Fragmentation leads to a great benefit from Open Trading and the opportunity is large,” he added. “We expect the municipal bond business to be a much bigger contributor as we look into 2022 and beyond.”

In the last quarter MarketAxess acquired MuniBrokers for approximately $40m to connect its trading technology with the liquidity of one of the industry’s largest electronic inter-dealer marketplaces and to build out a municipal bond data suite.

https://twitter.com/MarketAxess/status/1306205604680171521

McPherson said: “Municipal bonds and leveraged loans are notoriously manual and inefficient marketplaces. It is still early days for electronic trading adoption but we see early signs of behavioural shifts.”

The average daily volume for municipal bond trading was $95m in the first half of this year, up from $56m last year.

Chris Concannon, MarketAxess

Chris Concannon, MarketAxess

Chris Concannon, president and chief operating officer, said on the investor day that MarketAxess has recently made significant investments in municipal bonds, US Treasuries and environmental, social and governance-related bonds.

He said the municipal bond market is over $4 trillion in notional outstanding, with nearly $5bn in daily turnover, but electronic penetration is just an estimated 10% to 15%.

“We believe the municipal bond market is ripe for electronic trading adoption,” Concannon added. “For every 1% increase in market share we could realise approximately $10m in additional annual revenue.”

Rates

McVey highlighted the regulatory focus on US Treasury market structure, especially from Gary Gensler, the chairman of the US Securities and Exchange Commission.

“This is really the first time in our history that we have heard so much regulatory and market support for moving toward an all-to-all marketplace in US Treasuries,” he said. “We are close to getting ready to launch a request-for-quote platform in US rates and we look forward to building that out over the next year or so.”

Nichola Hunter, head of rates, said on the investor day that US Treasuries trade more than $600bn per day using multiple protocols, across multiple time zones, geographies and trading venues and there is an opportunity for further electronification.

Nichola Hunter, MarketAxess

Nichola Hunter, MarketAxess

“Government bond markets are highly electronic in the inter-dealer space but upwards of 50% of volume is still traded via voice protocols in the dealer-to-customer space,” she said.

Hunter continued there is an opportunity to drive innovation and change market structure following the liquidity issues of March year when volatility spiked due to the pandemic.

“Increased market stress has paved the way for MarketAxess to look at how Open Trading can be applied to government bond markets,” she added. “We will continue to support known and trusted protocols, such as a fully disclosed RFQ, and also drive change through access to new means of execution for the buy side such as click-to-trade streaming.”

Clients can execute against a live executable streaming price in an order book that is curated to their specific needs.

Automation.

Gareth Coltman, global head of trading automation, said at the investor day that clients have only just started the journey to automate their electronic trading workflows. For example, large asset managers are automating more than a quarter of all their activity on MarketAxess.

Gareth Coltman, MarketAxess

Gareth Coltman, MarketAxess

“We're discovering demand from clients to create more sophisticated automation workflows that reach across all available protocols and liquidity,” Coltman added. “Ultimately clients will be able to use our predictive analytics to optimize their trading workflows in real-time, automatically adjusting parameters to market conditions to ensure the most positive outcomes.”

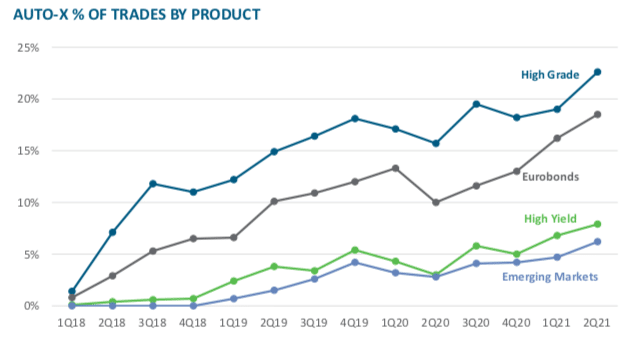

Auto-X allows buy-side clients to automate the submission and execution of RFQ orders. In the second quarter of this year approximately 17% of all platform trades were executed using Auto-X, versus 8% in the second quarter of 2018.

Large sell side dealers are deploying their own auto quoting algorithms in response to growing electronic volumes with algo-driven responses on MarketAxess having more than doubled since 2019 according to Coltman.

https://twitter.com/MarketAxess/status/1435619153692569602

Open Trading Auto-Responder allows buy-side clients to respond to inbound OpenTrading RFQ opportunities automatically and has generated more than 8,000 responses and over $5bn in response volume

since 2020.

“We anticipate this is likely just the beginning of the shift towards automation,” Coltman added. “We're only just entering the early phase of adoption which we ultimately expect to see across all markets and geographies.”

MarketAxess is adding automation capabilities to US treasuries and European government bond markets where he said high levels of liquidity should foster rapid adoption.

The firm is also rolling out Adaptive Auto-X which will connects multiple trading protocols available via Open Trading. Clients will be able to automate sophisticated, multi-step, multi-protocol workflows that mirror a traders decision making process today and maximize opportunities for cost saving.

Source: MarketAxess

Source: MarketAxess

Coltman said: “Adaptive Auto-X will allow clients to rest large blocks within the MarketAxess ecosystem, and then leverage our unique predictive analytics to drive choices on timing, sizing, or sequencing of workflows.”

Adaptive Auto-X launched in test in the second quarter of this year.

“We believe this technology will supercharge efficiency and cost benefits for clients, but will also be a catalyst for growth, lowering barriers to adoption of new markets and protocols,” he added.