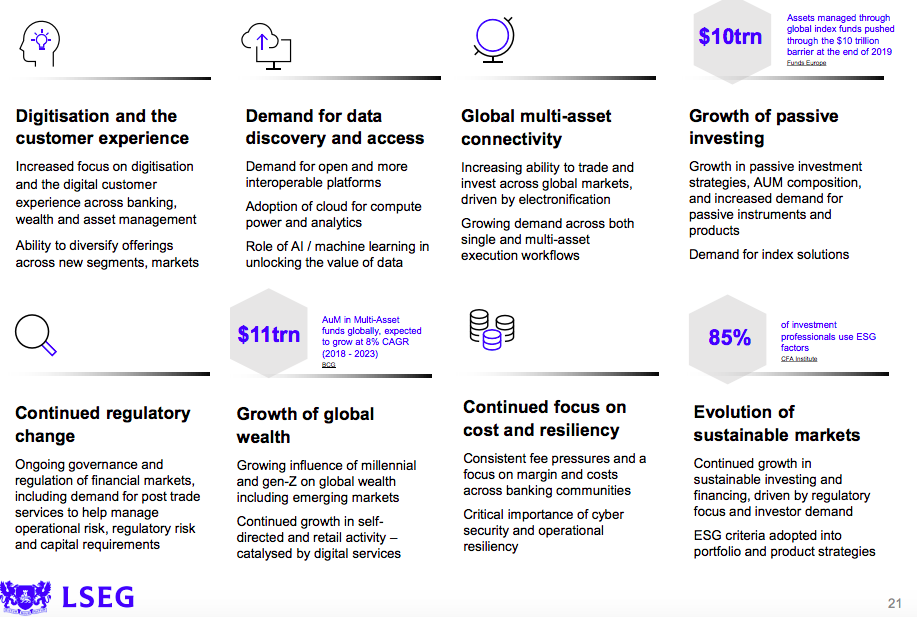

David Schwimmer, chief executive of London Stock Exchange Group, said the completion of the Refinitiv acquisition in January this year is transformational for the firm in meeting the trends of digitisation of financial markets, the demand for open access and open technology platforms, and increased consumption of data.

David Schwimmer, LSE Group

David Schwimmer, LSE Group

Schwimmer spoke this morning in a briefing on the preliminary results for the year ended 31 December 2020. The group reported an increase in total revenue of 3% to £2.1bn ($2.9bn) and a rise in total income of 6% to £2.4bn from 2019.

“It was a strong financial performance and our systemic role has never been clearer," he added. “The completion of the acquisition of Refinitiv was an important milestone and we are now truly global with a presence in North America, emerging markets, Europe and Asia.”

He continued that the exchange is focused on integration across the group’s three core operating divisions: data & analytics, capital markets and post trade.

“The financial market infrastructure is rapidly evolving and customers want stronger, deeper relationships with fewer partners,” said Schwimmer. “LSEG fits well within the evolving landscape of open access and increased electronic trading.”

Source: LSEG

Source: LSEG

Equities

It emerged that Amsterdam pushed London into second place for the volume of equities trading in Europe following the UK’s departure from the European Union. Average daily trading in London fell from €17.5bn to €8.6bn in January according to data from Cboe.

Schwimmer said the movement of trading of EU equities had been anticipated due to the EU share trading obligation.

“It was planned for with Turquoise, our multilateral trading facility, setting up a venue in Amsterdam for this activity,”he added. “The shift was well telegraphed and not surprising.”

Liquidnet, the institutional block trading network, said in a report that the proportion of activity in EU stocks traded on UK-based venues declined to 2.75% of EU addressable liquidity from 25% before Brexit.

“While the dislocation of EU liquidity seems unlikely to reverse given the investment trading venues have made in setting up platforms in the EU, regulators will continue to look closely at how liquidity forms and in particular, levels of dark and over-the-counter trading,” added Liquidnet.

https://twitter.com/Liquidnet/status/1365340259744120833

This week the UK government released the listing review, chaired by Lord Hill, which aims to strengthen UK’s position as a financial centre. The recommendations include updating rules around free float requirements and dual class share structures.

Schwimmer said the reforms were very constructive, especially lowering the required free float requirement from 25% to 15%, and introducing dual class shares in the London Stock Exchange’s premium listing segment.

https://twitter.com/InvAssoc/status/1367160543635734536

The review also recommend liberalising the rules regarding special purpose acquisition companies (SPACs), with appropriate safeguards for investors.

“There is some froth in the US market for SPACs and this could end poorly tor some investors,” said Schwimmer. “However, they useful to have in the capital markets toolkit and may make sense at a particular time. They have to be used thoughtfully and carefully.”