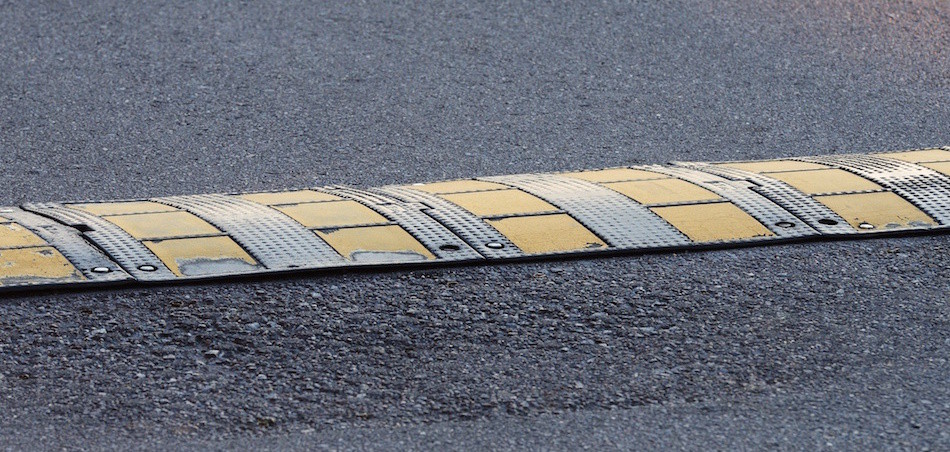

'Speed bumps' have been controversial since exchange operators like TMX Group announced its plans to implement them on the firm's TSX Alpha exchange.

Many market participants have voiced their concern that purposeful delays in trading-venue execution drive retail liquidity away from low-latency liquidity providers and further segment the market. Australian academics reached the same conclusion based on their analysis of publicly available data.

However, in a recent study jointly published by the Investment Industry Regulatory Organization of Canada and the Bank of Canada, the study's authors drew an opposite conclusion.

They found “no evidence that this redesign impacted market-wide measures of trading costs or contributed appreciably to segmenting retail order flow away from other Canadian venues with a maker-taker fee structure.”

The researchers used a detailed regulatory data set from the IIROC for its analysis and concluded that TSX Alpha's speed bump did not contribute to further segmentation in Canada.

The regulators also noted that after the introduction of TSX Alpha's speed bump in September 2015, this size of executed trades had increased 5% market-wide.

"This just validates what we already knew and what 6% of the market that is using already knows,” said Kevin Sampson, managing director, equity trading at the TMX Group. ”It certainly puts to bed a lot of misconceptions and some of the suspect findings of previous studies.”

TSX Alpha is not the only Canadian trading venue with a speed bump. Aequitas NEO opened its market to trading on March 31, 2016.

Each venue has garnered an average market share of executed trades of approximately 5.4% and 4.1% respectively.

Will the findings of the regulators likely lead to an increase in speed bumps across Canada's other 12 equities trading venues?

For Sampson, he thinks not.

“There is a natural point of saturation where there is only so much value that those venues can provide. I think we are getting pretty close to that point. When we introduced Alpha, we did not have the aspirations of it having a 10% share of the market. We identified that there was the need in the market especially around retail order flow is only so much that there was underserved market niche that we wanted to address with Alpha.”