IEX, the newest U.S. exchange operator, is looking for corporate listings, and the newest U.S. exchange operator has signaled it will compete aggressively on price to get them.

Best known for its 'speed bump' meant to deter predatory high-speed traders, IEX has been an exchange for only about a year and has garnered a bit more than 2% market share in equities trading. On listings, the firm faces a tough road to break in against entrenched incumbents NYSE and Nasdaq.

In a Sept. 1 regulatory filing, IEX said it will charge companies a flat annual listing fee of $50,000. By comparison, NYSE Arca charges a minimum annual fee of $30,000, but additional costs based on the company's market capitalization that can push the cost to as much as $250,000. Nasdaq charges a standard annual listing fee of $40,000 for companies with fewer than 10 million shares, but fees range up to $155,000 for companies with more than 150 million shares.

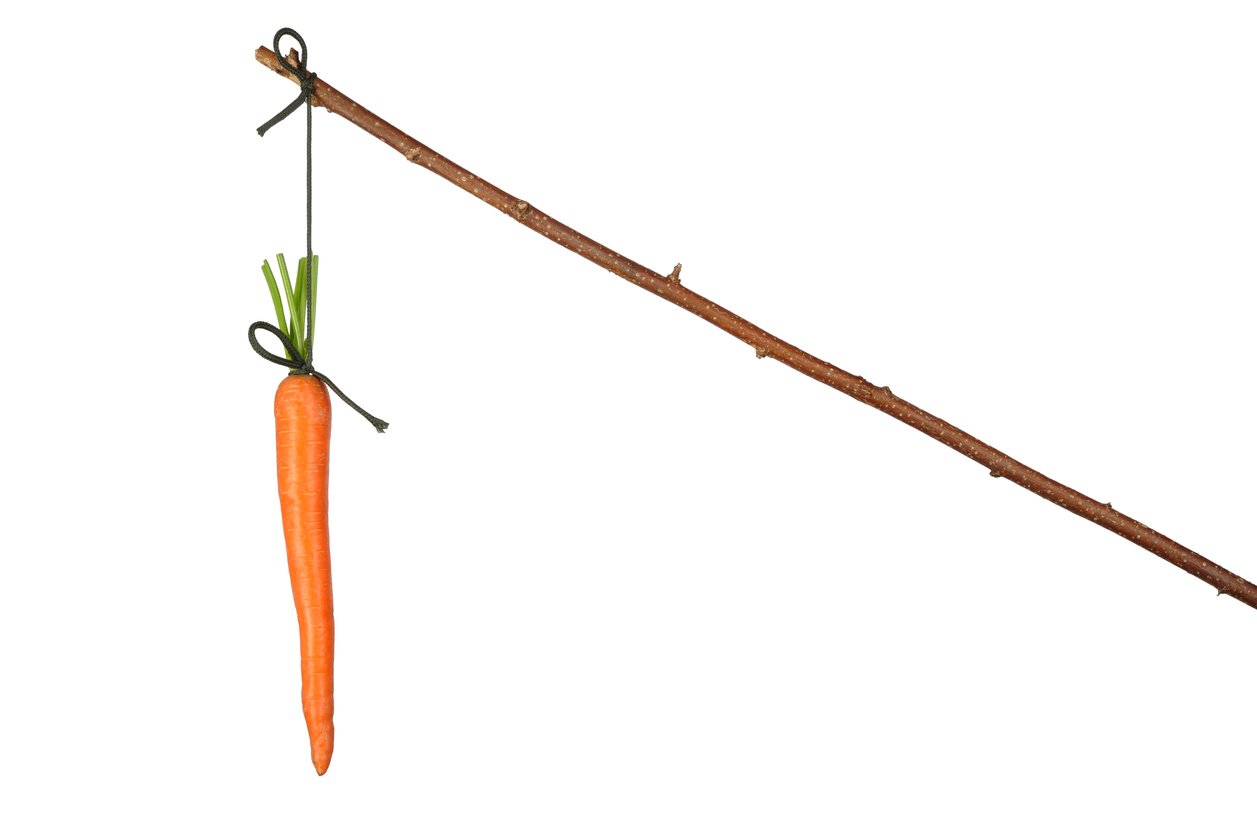

As a splashy way to get the ball rolling, IEX is offering at least $250,000 in 'first mover' fee credits, that is essentially five free years of listing to the first company who moves over from NYSE or Nasdaq by year-end.

"The exchange believes that a meaningful fee credit is necessary to incentivize currently listed companies to transfer their listing to IEX," the exchange said in the filing.