- Record month for ESG – nearly 20% of all ETF flows went green

- ESG ETFs grew 11.5% in January adding $20 Billion of assets

- Thematic ETFs dominate performance – Cannabis spikes as US liberalization hopes grow

Data from TrackInsight, the world’s first global Exchange-Traded Funds analysis platform, shows that ETFs continued their impressive growth streak over January 2020, reaching a new record high of $7.8 Trillion in AuM.

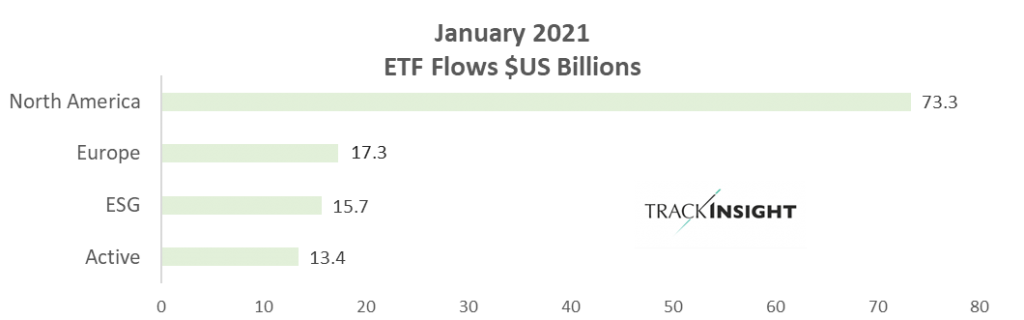

ESG ETFs, which nearly tripled assets in 2020, continued their growth streak in January rising by $20 Billion (11.5%) to reach a new high of $194 Billion in AuM- the 10th consecutive monthly record high. Of this, $15.7 Billion came from new assets making January the largest single-month in history in terms of ESG ETF flows.

Actively-managed ETFs also succeeded in gathering assets at a trend-busting pace, growing by 6.3% over January. $13.4 billion of new flows contributed to the segment reaching a new record of $293 Billion in AuM.

In contrast, the entire European ETF industry registered growth of $23 Billion over January, with $17.25 Billion of new flows. Delivering a monthly growth rate of just 1.8%, European listed ETFs lagged the North American market which grew 2.9% reaching $5.82 Trillion.

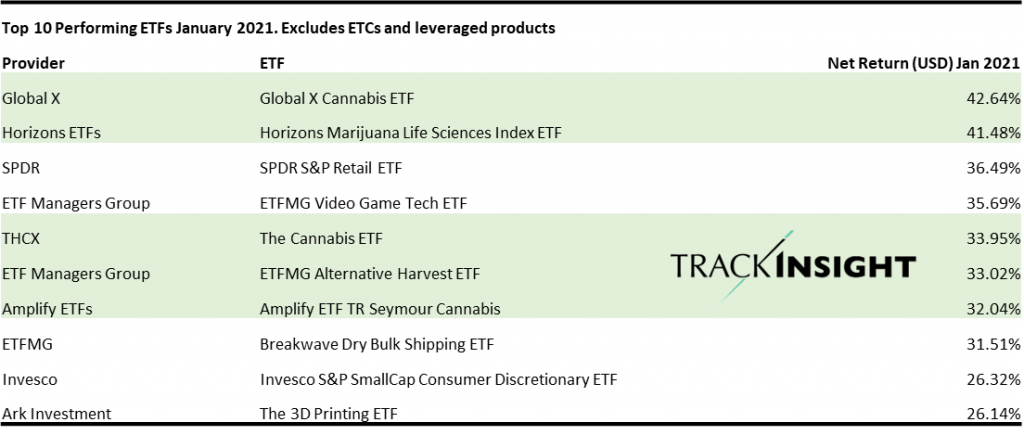

Thematic ETFs once again dominated performance with Cannabis ETFs holding 5 of the top 10 slots in January. Cannabis stocks have jumped after Democratic leaders under the new Biden administration indicated that they would propose legislation to end the federal prohibition on marijuana.

Anaelle Ubaldino, Head of ETF Research and Investment Advisory at TrackInsight commented: “ETFs entered 2020 with incredible momentum and this doesn’t appear to be slowing down. Investors have added over $90 Billion of new money to ETFs over January and, incredibly nearly 20% of that has been directed towards ESG strategies. Research from TrackInsight indicates that almost half of institutional investors plan increase their allocation to ESG ETFs this year and so for issuers, competing in ETFs will increasingly be about competing effectively in ESG.”

TrackInsight operates a unique global platform dedicated to ETF search, analysis and selection aimed at professional investors and is recognized as the leading source of independent and reliable information on over 6,500 Exchange Traded Funds listed globally. In 2021, TrackInsight launched ESG Observatory to provide data, research and transparency on the global market for ESG ETFs.

All data referenced in this release is in USD and sourced from TrackInsight as of 01/02/2021. ESG data from TrackInsight ESG Observatory as of 01/02/2021.

Source: TrackInsight