Goldman Sachs has increased its targets for long-term net inflows, alternatives fundraising and fees in asset management and wealth management by 2024.

David Solomon, chairman and chief executive of Goldman Sachs, presented at the Credit Suisse Financial Services Conference on February 17. He said synergy is key to the success of asset management and wealth management due to the firm’s ability to work across these franchises and drive internal co-operation.

“The fact that we have an extraordinary asset management platform is helping us in our wealth management business,” he said.

https://twitter.com/GoldmanSachs/status/1494302463117176832

Solomon said Goldman Sachs is now a five top active asset manager with $2.8 trillion dollars of assets under supervision, following its announced acquisition of NN Investment Partners, the Dutch fund manager. In August 2021 the bank announced the purchase of NN IP for approximately €1.6bn, and the deal is expected to close by the first quarter of 2022.

In addition, the ultra-high net worth franchise has total assets greater than $1 trillion according to Solomon.

He said: “One of the things we are now doing is laying out and growing the ability for more people at different levels of affluence to access our wealth management platform.”

In addition, he said Goldman Sachs is a top five alternative asset manager with $426bn of alternative assets. Researchers have predicted that capital allocated to alternatives will grow by 70% over the next five years and Goldman Sachs expects to capture a significant share of that growth.

“We have a huge platform inside the firm that is going to continue to grow,” Solomon added. “We are in all products globally and we think we are very well positioned in the active space.”

As assets under management have increased from $1.9 trillion to $2.8 trillion over the last three years, fees have increased at a compound annual growth rate of 12%.

Solomon said forward catalysts for asset management and wealth management are the firm’s Ayco platform, which provides financial planning programs for workplaces; and environmental, social and governance strategies which will be accelerated by NN IP; the number one platform in separately managed accounts; and alternatives.

As a result the firm has increased targets from its investor day two years ago.

The target of $250bn of organic traditional long term net inflows into the platform by 2024 has been updated to $350bn. In addition, the goal of raising $150bn in alternatives by 2024 has been increased to $225bn. Finally, firm-wide management fees should be more than $10bn by 2024, with more than $2bn in fees coming from alternatives.

Investment banking

Solomon expects investment banking in 2022 to be pretty active, although equity issuance will be lower than in 2021.

“The new normal for investment banking is not going to look like 2021 but it is still going to look a lot better than it has looked over the last 10 years, “ he added. “A high level of activity has continued to be high early this year although not as high as it was in 2021.”

He expects both investment banking and global markets to produce nice accretive returns for shareholders this year.

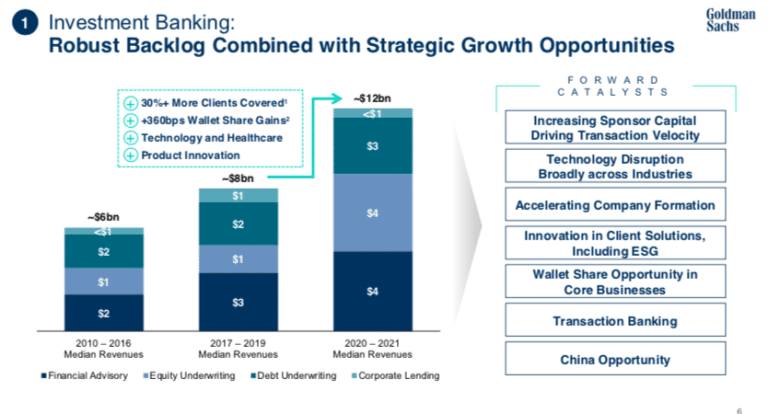

In his presentation Solomon said median revenue in investment banking between 2020 and 2021 was $12bn, compared to $8bn between 2017 and 2019 and $6bn between 2010 and 2016.

Growth has been due to the environment but also because the opportunity set is meaningfully bigger than it was five to 10 years ago.

“There are more companies that we can footprint against, and we do a very good job of doing that,” added Solomon. “There are a lot more companies with market caps of $500m to $3bn than seven or eight years ago and over time that footprint should grow.”

Other growth factors are the climate transition, the enormous investment going into technology and healthcare - which both need investment banking services, and the activity of financial sponsors as Goldman Sachs started investing in its financial sponsors franchise 10 to 15 years ago.

“We also think that scale matters and there is going to be continued consolidation and continued repositioning given that we are moving into an environment with above-trend inflation for a period of time,” said Solomon.

Global markets

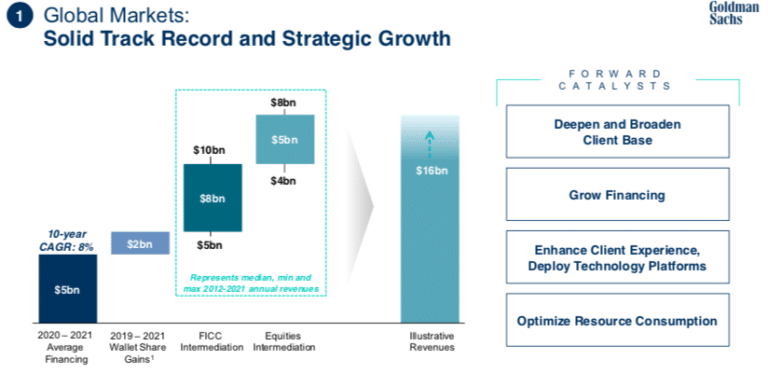

At the investor day two years ago Goldman Sachs said it could drive double-digit returns in this business.

Between 2019 and 2021 the bank made $2bn of wallet share gains which Solomon believes is sustainable as rivals found it harder to compete at scale. In addition, over the last 10 years FICC intermediation made between $5bn and $10bn while equities intermediation made between $4bn and $8 bn.

“We still think there's a little bit of upside and the business can make revenues greater than $16bn,” he added. “We are confident we can deliver double digit returns.”