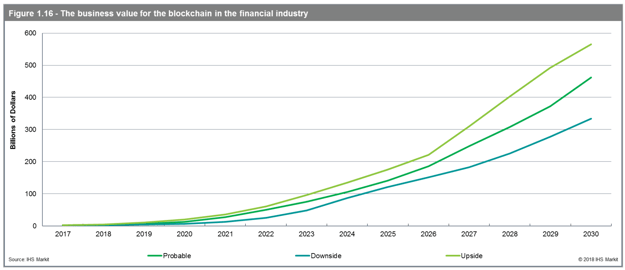

Barely a day goes by without a fresh announcement about banks and financial institutions using blockchain technology to transform significant parts of their businesses. In fact, the value of blockchain in the financial sector reached $1.9 billion in 2017, according to business information provider IHS Markit. With the projected increase in the number of blockchain projects expected to launch and become commercially deployed in the coming years, revenues are projected to reach $462 billion by 2030.

“The Securities and Exchange Commission in the United States, the Financial Conduct Authority in the UK, the Hong Kong Monetary Authority and other regulatory bodies are reacting positively towards blockchain technology within the financial sector,” said Don Tait, principal analyst, IHS Markit. “The backing by these regulatory bodies bolsters the credibility of blockchain technology, helping it become more mainstream.”

There are numerous ways the financial industry can leverage blockchain, including cross-border payments, share trading and syndicated lending. Over the next decade, the global financial market, which includes insurance and fintech, will continue to be the largest value market using blockchain technology.

Because the financial sector includes markets of significant value, even a small percentage of cost savings and efficiency gains can lead to significant business value for companies and industries that introduce blockchain technology. The derivatives market, for example, is worth around $544 trillion a year and the market capitalization of all the world’s stock markets is equal to $73 trillion.

“By applying blockchain to the clearing and settlement of cash securities – specifically, equities – investment companies could save up to $12 billion in fees,” Tait said. “Blockchains can also save financial organizations money, by cutting out many of the traditional middlemen involved in the financial sector.”

The IHS Markit “Blockchain in Finance Report” examines the global market for blockchain in the financial sector. It provides a current snapshot of this market and examines the factors that are projected to hinder and drive growth in the blockchain market from 2017 to 2030.