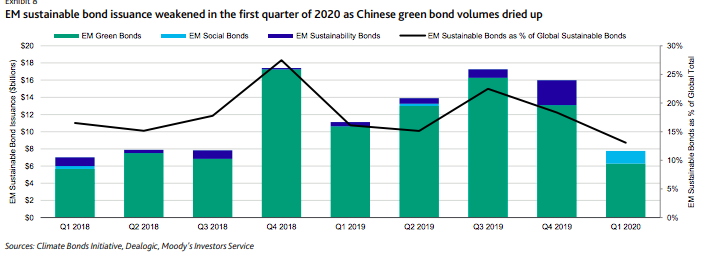

Emerging market sustainable bond issuance was at its lowest level for two years in the first quarter of this year, but there is still strong potential for growth, according to Moody’s Investors Service.

The ratings agency said in a report that emerging market sustainable (green, social and sustainability) bond issuance was $7.7bn ($7.1bn) in the first three months of the year, the lowest since the first quarter of 2018. The study, Coronavirus fallout dampens Q1 2020 green bond volumes while spurring social bonds, said emerging market volumes were 13% of the global share of sustainable bonds, down from 18% for the whole of last year.

https://twitter.com/MoodysInvSvc/status/1257577558872383489

Moody’s added: “Despite economic challenges associated with the coronavirus in the coming months, we continue to see strong potential for sustainable bond growth throughout EM economies over the long run given their susceptibility to environmental, social and governance risks and huge investment needs to finance sustainable development.”

The ratings agency continued that the decline can be mostly attributed to the Chinese green bond market, which made up 60% of total EM green bonds in 2019, being largely non-existent during the quarter.

“Increased issuance in Latin America somewhat offset declines in Chinese green bond volumes as Chile's large sovereign green bond helped support EM issuance,” added Moody’s. “EM sustainable bond volumes will be subject to similar headwinds as the broader market throughout the year as economic contraction because of the coronavirus outbreak causes prolonged market disruption and potentially weighs on investor sentiment.”

The study said there have already been signs that EM sustainable bond markets are starting to mature, a trend Moody’s expects will accelerate once the economic challenges associated with the coronavirus outbreak begin to wane. The ratings agency continued that emerging market sustainable bonds have begun to diversify regionally as a greater variety of issuers have come to market, sector diversification is accelerating and there has been increasing issuance of social and sustainability bonds.

Amundi-IFC Emerging Market Green Bond Report

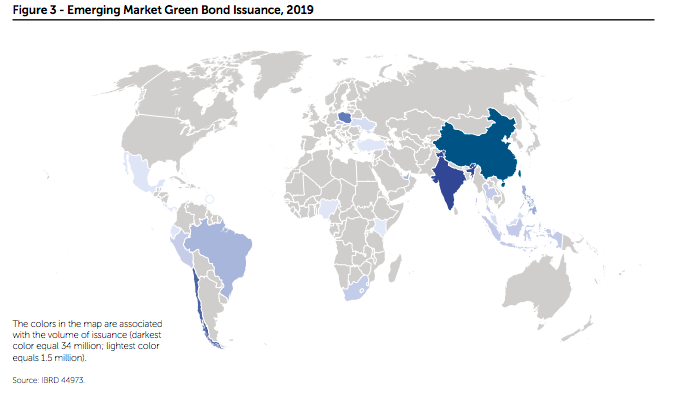

Amundi, the largest European asset manager, and IFC, a member of the World Bank Group, said in their annual Emerging Market Green Bond Report 2019 that issuance rose 21% to $52bn last year, with China as the largest issuer. The size of EM green bond issues ranged from $1.5m to $2.9bn with financial institutions the largest issuing sector.

https://twitter.com/IFCEurope/status/1259830248373444609

Yerlan Syzdykov, global head of emerging markets at Amundi, said in a statement: “Although it is hard to assess the long-term impacts of the current crisis and there are still many challenges to scaling green bonds, momentum is building with more investors seeking to align their investment strategies with environmental considerations. Our research indicates that the green bond phenomenon, especially in emerging markets, shows potential signs of resilience during these unprecedented times.”

Maxim Vydrine, co-head of emerging markets corporate & high yield debt at Amundi, said in the report that the fund manager had not observed any meaningful green premium for new primary market issuance in emerging markets as there is no excessive demand or scarcity to be ‘priced-in’ at this stage.

“Demand for EM green bonds should increase over time as the market deepens and dedicated EM green bond funds are launched," added Vydrine. “Higher weights for green bonds in EM ESG indexes should also enhance demand as these indexes gain traction.”

Emerging and frontier market SMEs

BlueOrchard Finance, part of the Schroders group, is collaborating with a number of potential investors, to develop a new fund to provide funding for micro, small and medium-sized enterprises in emerging and frontier markets that have been affected by the Covid-19 pandemic.

The asset manager said that while significant funding has been mobilised by governments and central banks in developed economies, this is not necessarily the case for a number of developing markets. The new fund would support financial institutions and their portfolio companies by providing flexible financing schemes and helping to limit disruption to businesses, maintain jobs and re-establish a path to growth.

The initiative will be in two-phases. The first ‘stabilisation’ phase will provide liquidity to micro and small businesses over the coming months and then move into the ‘growth and recovery’ phase supporting financial institutions.

Peter Fanconi, chairman of the BlueOrchard board, said in a statement: “If measures are not taken to do this, more than a decade of progress towards ending poverty could be lost in a few short months. We firmly believe that impact investing has a role to play in helping to overcome this current challenge.”

The initiative would be Luxembourg-domiciled, with the first closing planned for July 2020.