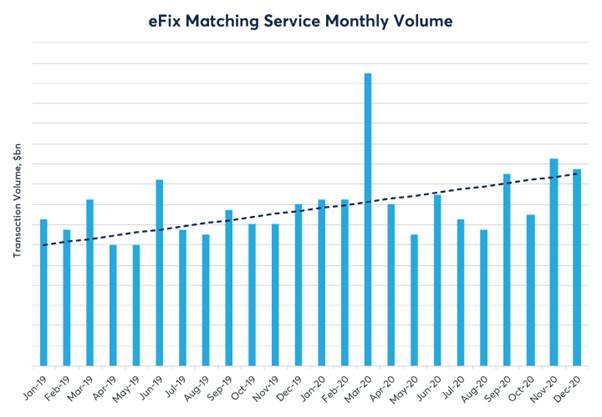

Last year was a record-breaking one for the CME EBS eFix Matching Service - hitting new daily and monthly volume records.

The EBS eFix Matching service, which allows banks to execute fixing risk ahead of running calculations around the WM/R 4pm period, experienced all-time highs of $5.775bn last March, and a year-on-year increase of 21 % on 2019 volumes. Already up 25% on this time last year, the platform also had a strong year end after recording $19.7 billion (single count) in November.

Source: EBS.

Source: EBS.

“We have witnessed an influx of market participants looking to automate their price fixings,” said Jeff Ward, Global Head of EBS. “While there has been a general trend towards wanting to minimise human involvement in fixing orders, the pandemic has unquestionably accelerated this shift. As more banks continue to seek out a central solution for fix execution to ensure they better manage their risk, we look forward to continuing to offer a wider array of daily fixes throughout 2021.”

Source: CME