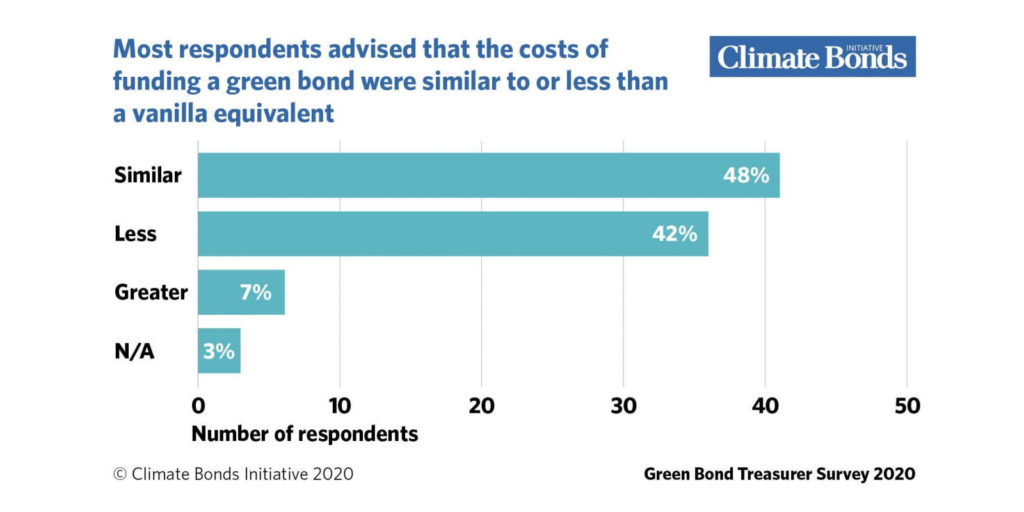

Demand for green bonds is higher than for their vanilla equivalents while the cost of funding is the same or lower according to a survey from the Climate Bonds Initiative.

https://twitter.com/ClimateBonds/status/1252599663213064193

The non-profit organisation’s first Green Bond Treasurer Survey had 86 respondents from 34 countries representing nearly half, 44%, of the identified green bond universe.

The majority, 70%, of respondents said the demand for their green bonds was higher than for vanilla equivalents while nearly half, 42%, said green bond costs were lower.

Sean Kidney, chief executive of the Climate Bonds Initiative, said in a statement: “The investor appetite is there. It will only increase as asset owners and institutional investor calls grow for climate, resilience measures and sustainability considerations be at the core of stimulus and economic response programs.”

None of the respondents said they they received less interest for a green bond compared to vanilla equivalents.

The study continued that the costs of funding for green bonds were lower than for vanilla bonds for larger issuers, and those with more years in the green bond market - which may be due to spreading the costs of issuance, incurring economies of scale, and achieving a lower interest rate.

“For example, Berlin Hyp recounted that unique expenses, including the adaptation of IT systems and internal processes, were incorporated into the cost of its first green bond, but the ramifications extended to subsequent issues,” said the survey.

Nearly all respondents said green bonds diversified their investor base and facilitated more engagement compared to a vanilla issue, which benefits future financing and enhances liquidity. For example, a traditional euro issuer sold a green bond in US dollars to new investors, who started buying the vanilla bonds as well.

Investors also interrogated issuers on the use of proceeds, the green bond framework, and post-issuance reporting which gave them more knowledge of the firm.

Kee Chan Sin, treasurer as telecoms firm Verizon, said in the report: “The extra financial costs of issuing a green bond were negligible. It is the effort, not the cost which is the barrier to entry.”

The survey was sponsored by Danske Bank and Luxembourg Stock Exchange with supporting analysis from Henley Business School from the University of Reading.

Green bond performance

NN Investment Partners, the Dutch asset manager, found green bond demand and flows have remained intact during the current Covid-19 pandemic.

Bram Bos, lead portfolio manager green bonds at NN IP, said in a statement that in the current market both traditional and green bonds sell off.

“In the last few weeks, there has not be a significant difference in how green bonds have behaved in comparison to their traditional peers," he added.

He noted that most managers are holding onto the green bonds in their portfolios and that flows, and demand, are increasing rather than diminishing. In addition, the corporate green bond index has outperformed the traditional corporate index.

“The green bond corporate index does not include airlines or energy companies – those sectors were hit by the compounded effects of the coronavirus and the plummeting oil price,” Bos added.

However the green bond index includes utility companies that he said tend to be better prepared for uncertain times, more forward looking and are often better managed than firms that do not issue green bonds.

“Although it’s still early days to draw any major conclusions, we don’t see interest in green bonds diminishing in terms of our clients, nor are our funds experiencing much outflow,” he added. “We should see a continuation of the growth of the last two years and the effects of the crisis may even give the green bond market an additional boost.”

NN IP also expects the sovereign green bond segment, 17% of the total market, to benefit from the response to the Covid-19 pandemic as governments need to finance their increased spending.

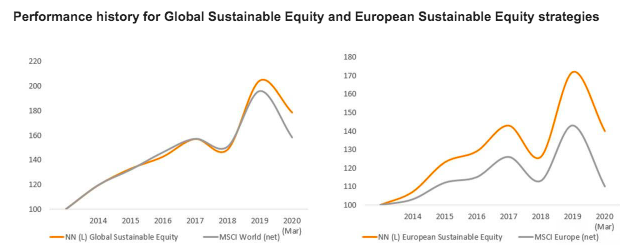

Sustainable equity strategies

In the equity market, sustainable strategies have also outperformed according to NN IP.

The Dutch manager said both its global and European sustainable strategies have displayed considerable resilience in the face of the coronavirus. For the year to date, the global variant has beaten its benchmark by 6.5%, while the European strategy has generated relative outperformance of 4.1%.

Hendrik-Jan Boer, head of sustainable and impact equities at NN IP, said in a statement that the team had identified remote working as a growing trend before the crisis began and has only added three names in the past two months.

NN IP believes that the crisis has intensified investors’ focus on environmental, social and governance factors, with social becoming more prominent, as investors review how companies are supporting their employees.

“It’s now more evident than ever which companies are able to navigate this period of uncertainty without being punished for bad capital allocation or frustrating equity investors by issuing new shares,” added Boer. “This is all determined by their long-term governance approach, and from our perspective, the companies in our portfolios have lived up to our expectations during this crisis.”

Sustainable investing

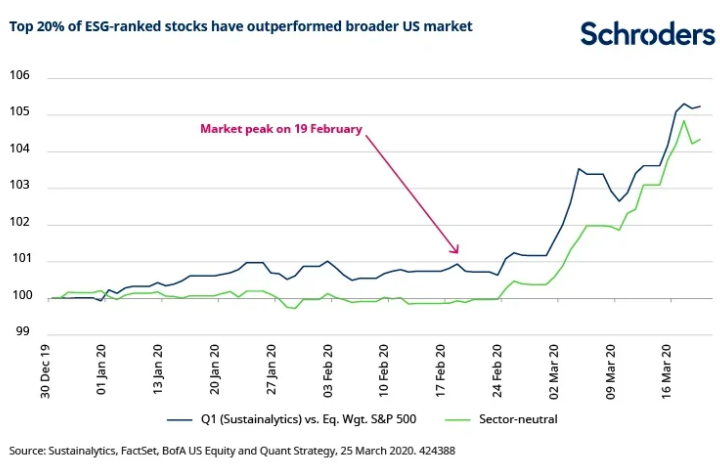

Schroders, the UK fund manager, said asset owners have continued to demand sustainable/ESG funds in the market downturn.

Katherine Davidson, portfolio manager, global & international equities and Scott MacLennan, fund manager/research analyst, European equities, said in a blog that sustainable investing has grown exponentially. In the US, net flows into sustainable funds reached $20.6bn last year, more than four times the previous annual record in 2018.

https://twitter.com/MorningstarInc/status/1252950198348849152

“As much as we are sceptical of passive ESG funds, it is interesting to see that the MSCI ESG Leaders indices have outperformed their mainstream counterparts in most geographies, albeit modestly in most instances,” they wrote.

The biggest outperformance has been in the UK where FTSE 100 ESG Leaders index has fallen -27.3% year-to-date compared to -33.7% for the FTSE 100 index. The MSCI ESG Leaders indices target companies that have the highest ESG rated performance in each sector of the parent index.

The blog said: “Research by Bank of America Merrill Lynch also finds that the top 20% of ESG-ranked stocks outperformed the US market by over 5% during the recent sell-off. This is partly because ESG leaders have so far seen smaller earnings per share cuts than ESG laggards.”

In addition Schroders said ESG exchange-traded funds have had lower outflows and are still net positive year-to-date compared to record outflows from equities overall.

“Moreover, it seems to us that this crisis has actually increased the visibility and perceived importance of sustainable business practices,” said the blog. “Companies’ treatment of their customers, employees and suppliers is under greater scrutiny than ever before.”