As a senior banker at a conference I attended recently described it, Banks and Asset Managers ‘are suffering from regulation fatigue’. And yet, Collateral reporting stands out among the proposed changes in ESMA’s new RTS for EMIR Reporting. In addition to expanding from five to fifteen reportable fields, ESMA will require firms to bucket collateral valuations by Initial Margin, Variation Margin and Excess Collateral, and further by Posted and Received. This article, in addition to summarizing the benefits and challenges of the new RTS, provides an in depth analysis of the proposed changes in the RTS.

The European Union’s European Market Infrastructure Regulation (or EMIR to its friends) has trade reporting as a key pillar of the mandate to monitor and identify systemic risk. Comprehensive reporting of the OTC & ETD derivative trades, lifecycle events, trade valuations and the associated collateral is essential to provide the regulators with transparency into where risk occurs.

Under EMIR the European legislators arguably went further than many of their G20 counterparts in stipulating that both parties to any eligible trade should report. This ‘dual-sided’ reporting has proved contentious since it was first announced and, as recently as last April 2016, many of the leading financial industry trade associations (including ISDA, SIFMA, GFMA and the IA) published a joint paper arguing for single sided reporting to be adopted globally.

How much impact this paper will have remains to be seen. The European experience to date has seen ESMA, the European Parliament and European Commission maintain their stance that dual sided reporting improves the quality of the data and highlights reporting errors. Although there were murmurings recently that they might consider diluting this requirement for some firms (possibly Non-Financials or Non-Financials below the clearing threshold). Those murmurings aside, since the recent consultation paper on draft technical standards for SFTR (Securities Financing Transaction Regulation) published last month has dual sided reporting and an EMIR like Intra/Inter TR reconciliation it seems reasonable to conclude that dual-sided reporting remains central to the European regulators’ plans for trade reporting for the foreseeable future.

Proponents of dual sided reporting argue the benefits include:

- Each party will identify the counterparty proving the trades were booked against the correct entity.

- Discrepancies on the trade financial details (product, price, currency, duration, notional amount etc.) will be detected and can be resolved.

- Each party will provide the regulators with their calculated valuation of the trade along with the associated levels of collateral in place.

The intentions of the regulators are clear with regards to the last item. They wish to monitor that each party to any given trade is reporting a valuation that isn’t wildly at odds with the other party’s valuation. This makes sense because if I think the position is worth £1 million and my counterparty thinks the same position is worth £10 million then clearly one of us is in big trouble! In addition, they want to ensure that the position is appropriately collateralised so that the risk is mitigated if market conditions deteriorate.

Collateral and valuation reporting under EMIR is currently a fairly simple model, sharing many common attributes with the collateral and valuation reporting introduced by the CFTC under Dodd-Frank.

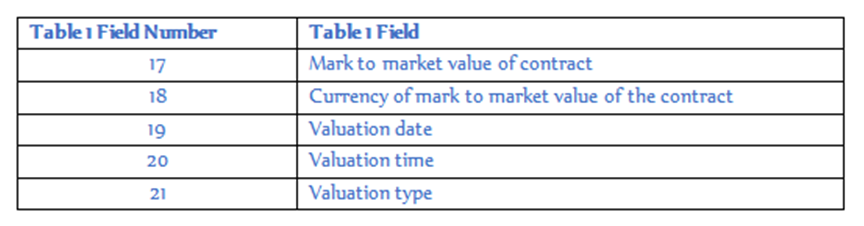

For valuations, the calculated trade value, currency, date/time when that value was last calculated and the valuation type are required.

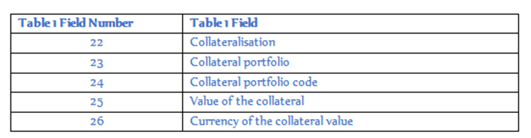

Similarly, for collateral reporting the fields are the value, currency, the collateral portfolio code, the type of collateralisation (Fully, Partially, One-way or Uncollateralised) and an indicator as to whether the trade was collateralised at individual trade level or as part of a portfolio/basket of collateral.

Compared to the valuation reporting there was more confusion around the collateral reporting requirements; the contentious issues included:

- Whether to report collateral in each currency held or aggregate into one currency.

- Whether to report negative values.

- Difficulties in adhering to the ’10 numerical digits’ format prescribed for the collateral portfolio code.

Many of these issues were clarified over time via the EMIR Q&A’s issued by ESMA. However, in the rewrite of the EMIR RTS (Review of the Regulatory and Implementing Technical Standards on reporting under Article 9 of EMIR) ESMA has gone much further to address these issues.

Valuation reporting looks pretty much the same in the new RTS. The only real change is that ‘Valuation type’ now supports CCP valuation as well as mark to market and mark to model.

By comparison, Collateral reporting in the new RTS looks a far more daunting prospect. The five reportable fields in the original RTS have been replaced with fifteen fields as ESMA seek to break collateral valuations down into buckets for Initial Margin, Variation Margin and Excess Collateral. These buckets are then further divided into Posted and Received.

The good news is the much criticised 10 numeric digit format for ‘Collateral portfolio code’ has been replaced with a much more pragmatic “Up to 52 alphanumerical characters including four special characters: – _”

Less welcome news for the reporting firms that face having to update their reporting solutions significantly is that Value & Currency have been replaced by twelve new fields as ESMA try to obtain a far more granular understanding of the collateral flows. Clearly this is a much bigger task for the reporting firms to source, validate and report all these values on a daily basis.

Across the Atlantic meanwhile the recent CFTC Request for comment suggested a completely different model for collateral reporting with the American regulators advocating the use of ‘Netting Sets’ for the reporting of collateral. The proposed CFTC approach further diverges from the ESMA approach by suggesting that firms should also report the collateral amounts that are contractually required rather than just the actual amounts pledged/received.

The CFTC Request for Comment closed in March. Risk Focus participated in the consultation and along with other firms pointed out that by diverging so much from the ESMA model the CFTC was increasing the burden on firms caught with reporting obligations to both regimes.

In the meantime you also have other regimes such as ASIC that introduced an ESMA-like model for collateral & valuation reporting. And regimes such as the Canadian territories that unsurprisingly are following the CFTC model. That is to say, in both cases they are following the old models. This is important because it implies that for global banks reporting to many different regimes they face the fairly mountainous task of adapting their European reporting to the new ESMA model, adapting their CFTC reporting to the new CFTC model and at the same time continuing to report to regimes like ASIC and Canada on the old model. A daunting prospect indeed for these firms in terms of their reporting solutions and control frameworks.

Risk Focus already have a beta version of the new EMIR RTS including all the collateral changes within our Validate.Trade solution. Additionally, we are actively working on adding a beta version for the CFTC Request for Comment specification. Whilst we fully expect the CFTC spec is likely to change substantially between now and any implementation window these beta versions allow our clients to visualise, understand and even test the new reporting requirements well ahead of the curve.

To summarize, for the regulators the benefit of having a more detailed and clear understanding of the collateral flows versus the size/risk of the associated trades is obvious. The reporting firms though, as I mentioned up top, are suffering from ‘regulation fatigue’. These evolving requirements involve an additional burden on costs and efforts. The scale of the collateral changes outlined above mean that it won’t be just the reporting systems needing to be enhanced, in many cases the collateral management systems will also need significant enhancements to meet the upcoming challenges. It remains to be seen whether other regulators such as ASIC, Canada, HKMA, MAS and the many others will follow suit and which path they choose. It’s clear that collateral and valuation reporting is very far from a job done and the path ahead looks long and challenging.