Clearstream, Deutsche Börse’s central securities depository, will next month become the largest market to join TARGET2-Securities and double volumes on the European Central Bank’s project to harmonize securities settlement in the Eurozone.

The German CSD said in a statement yesterday it will go live on T2S on schedule next month in the fourth and penultimate wave of migration to the settlement platform. The statement added this will bring about 40% of overall expected volume to T2S and double current volumes.

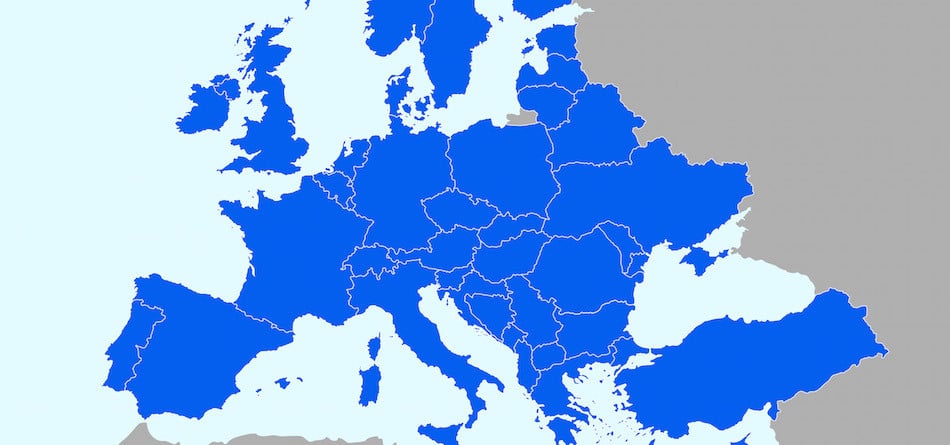

T2S allows settlement in central bank money across borders, central securities depositories and currencies so there is no difference between domestic and cross-border transactions. The settlement platform began operating in 2015 after being launched by the European Central Bank in 2008 to end fragmentation in securities settlement across the Eurozone as the cost of cross-border transactions could be 10 times more expensive than domestic transactions.

Marc Robert-Nicoud, chief executive of Clearstream International, said in a statement: “We look forward to crossing the finish line of this mammoth project, which represents a fundamental reshaping of European capital markets. T2S brings us one step closer towards a Capital Markets Union. With our T2S services, we will support our customers to leverage the benefits of the new platform and enable them to profit from unique economies of scale as well as improved liquidity and collateral management.”

In addition to Clearstream, the central securities depositories of Austria, Hungary, Slovakia and Slovenia will also migrate to T2S next month and join the 12 CDs already on the platform. The final T2S wave is scheduled for September this year.

Powering the flow of global capital, capital markets investor insights, a survey last year from Deutsche Bank Global Transaction Banking, found that 51% of respondents were positive about their experience using T2S for settlements. in addition 27% said it has been somewhat or very negative and 22% said they haven’t used T2S or that it was too early to say.

The Deutsche Bank report said individual comments by respondents were almost exclusively positive about T2S. One chief operating officer of a UK asset manager said in the survey: “It has simplified the way we carry out settlements. It is a unified system, cross-border fees are less and it has reduced the risks we face.”

Last November UBS, Clearstream and Citi announced a service to give market participants a single point of access to T2S, along with a single integrated and optimised collateral pool and comprehensive post-trade services.

UBS is the launch client for this service which starts this year. Citi will provide clearing, settlement, and asset servicing, while Clearstream will provide safekeeping, lending, and securities financing solutions.

Colin Parry, UBS head of securities, collateral & derivatives, said in a statement: “We expect network and operational simplification benefits, and also improved management of liquidity and collateral. We believe that the model sets a new industry standard, will enhance our client value proposition and will unlock numerous front-to-back efficiency gains that allow us to play a part in hitting UBS’s existing cost commitments.”