Ed Tilly, chairman, president and chief executive of Cboe Global Markets, said on the exchange group’s first quarter results call that one of the top priorities is global expansion of its data and analytics offering.

Catherine Clay, executive vice president, has the responsibility of delivering this aim as she has been appointed head of a newly created division, Data and Access Solutions.

In March this year Cboe announced the combination of Information Solutions with Market Data and Access services. Clay was promoted from senior vice president, Information Solutions, and joins Cboe's executive leadership team in her new role.

Catherine Clay, Cboe Global Markets.

Catherine Clay, Cboe Global Markets.

She told Markets Media: “Thinking about how to use the strengths of each division has unleashed a lot of creative thinking in the few weeks we have been a united and integrated team.”

Clay has been with Cboe since 2015 when the group acquired the options market data services and trading analytics platforms of LiveVol, where she had been chief executive. She began her career as a clerk in Interactive Brokers' market-making unit, Timber Hill, and rose to director of floor trading and operations. In 2006 Clay became a co-founder of options market maker Thales.

Tilly added that as the trading environment becomes more globalized, customers want greater efficiency in market infrastructure services and Cboe’s goal is to align its business to address these client needs for global data and analytics.

Clay said: “It is an expensive proposition for firms to have many different points of contact and vendor relationships and they are keen for us to solve that issue for them globally. We can alleviate that pain point for our clients by thoughtfully combining both these businesses."

She continued that Cboe needs to meet clients where they live and provide a single point of entry for all data, analytics and indices.

“It quickly became apparent as the Chi-X Asia Pacific acquisition was emerging that we should not be introducing points of fragmentation for our clients who already have a fragmented experience in the global markets,” added Clay. "Another catalyst for the combination is the launch of our European derivatives market this year and we are focused on providing analytics and services data offerings for this space.”

Cboe has announced the acquisition of Chi-X Asia Pacific, an equities alternative trading system, and the launch of a new European derivatives marketplace on 6 September 2021.

Edward Tilly, Cboe Global Markets.

Edward Tilly, Cboe Global Markets.

Tilly said: “In connection with the Chi-X Asia Pacific, Cathy will lead our efforts to build the first truly global equities market data platform that is expected to offer data from most major markets around the world.”

Data and Access Solutions

Clay continued that the new division is already trying to solve some of the plumbing for the clients.

“For example, we are trying to harmonise legal agreements with clients globally and making sure that our entitlement systems are the same for any product,” she added. “Now what's happening is the ideation around our global market data strategy and what we are going to bring to market first that makes sense for clients.”

Index data, for example, could start migrating more towards real-time market data. She explained that the real-time market data business was ahead in terms of having a cloud distribution strategy, which now provides a nice tailwind for the rest of the analytics business.

She has experience in bringing technology businesses together as last year Cboe made three acquisitions which were integrated into Information Solutions - Hanweck, a real-time derivatives risk analytics company based in New York; FT Options, a provider of research and analytics functionality across options, futures and light exotics; and Trade Alert, a real-time alerts and order flow analysis service provider.

https://twitter.com/CBOE/status/1267833494178344968

“The three acquisitions we made last year really solved for clients’ needs as we plugged gaps from a trade lifecycle perspective,” said Clay. “We are serving clients well in the pre-trade part of the workflow, adding real-time heavy compute analytics for margin and portfolio risk and offering post-trade through our valuation, pricing and reference data services.”

She explained that growth will come from taking what Cboe does well in the US, as a dominant provider of indices, data-driven products and analytics, and opening this up to a broader global audience.

“Clients will transact on our new markets in Europe, Canada or potentially Australia and Japan, and will need the tools that we have been developing for decades in the US,” she added. “We have a good handle on solving workflow for clients and now it's just taking this to a more global audience and thinking about incorporating different asset classes.”

Digital assets

In December last year Cboe signed an exclusive licensing agreement with CoinRoutes to disseminate the trading software firm’s RealPrice data feed which provides a consolidated Best-Bid-Offer (BBO) from all major cryptocurrency exchanges incorporating the actual cost to trade specific quantities of a digital asset in real-time.

https://twitter.com/CBOE/status/1365013848139390983

Clay said the the CoinRoutes’ RealPrice data feed was Cboe’s initial entry into data for crypto and digital assets, which are nascent asset classes.

“We would love to expand if we can identify meaningful and somewhat unique points of data within the digital asset sphere,” she added.

Clay continued there is also a broad focus on environmental, social and governance issues within Cboe.

John Deters, chief strategy officer at Cboe, said on the results call that Cboe will proceed with ESG products – either data or tradable contracts – together with its existing partner such as FTSE Russell, MSCI and S&P who already provide ESG data and indices.

“We have not yet identified exactly how we are going to enter into ESG data but that thematic magnet across indices and data is there,” added Clay.

She said the priority for the new division this year is to take a client-centric view of their pain points and make sure Cboe understands how they want global data and analytics products and services to be delivered.

“We need to deliver in ways that improve or optimise their workflows to allow them to succeed in their strategic objectives,” Clay added.

By the end of this year Clay would like the business to be foundationally more integrated.

"Once the plumbing is done we can emerge into next year with a thoughtful roadmap for the most meaningful services that we want to deliver,” she said. “Our new EU derivatives business is front and centre so we’ll make sure we are there for those participants, and then think about how we’ll integrate our data offering for a global audience.”

Revenues

Source: Cboe.

Source: Cboe.

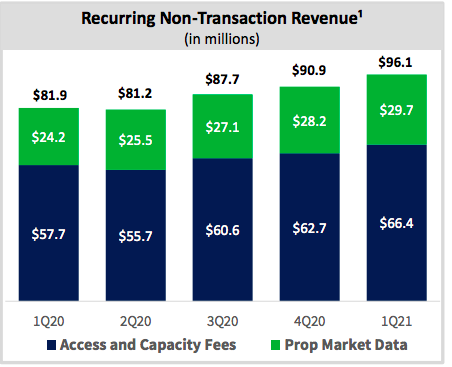

In the results presentation Cboe said it believes the new division will create an opportunity to further grow proprietary non-transactional revenue, which was approximately $350m in 2020.

The company increased its target for 2021 organic annual growth recurring non-transaction revenue from 6% and 7% to between 10% and 11%, after exceeding targets in the first quarter of this year.